As COVID-19 retreats, Portugal’s Hospitality Industry sees a remarkable resurgence, reaching unexpected heights not seen before. The unpredictable situation experienced worldwide during the pandemic served as a turning point across all sectors, delineating a distinct ‘before’ and ‘after,’ particularly for Portugal’s hospitality industry.

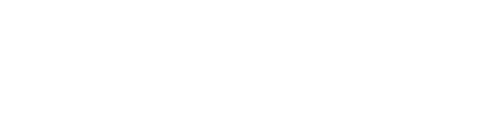

After several decades of growing progress seen for the Hospitality Industry in Portugal, the world found itself in the COVID-19 pandemic and under all the extreme measures that several governments implemented to deal with the situation. This sector suffered an inflexion point which was pictured by the yearly decrement of -17.8% observed in 2020 for average daily rate per room values (ADR); while increments around 2% were found for 2018 and 2019. This decrease was due to the extraordinary uncertainty associated with COVID-19 pandemic, which exposed hotels to adverse economic and financial consequences in Portugal. In fact, exploring data of the ‘before’, ‘during’ and ‘after’ the pandemic, and the hypothetical situation of not having to go through something like it (Figure 1) we can observe the completely different scenarios from March 2020 to November 2023.

Figure 1. Comparison between real ADR data and ‘COVID-free’ simulated ADR data, in Portugal.

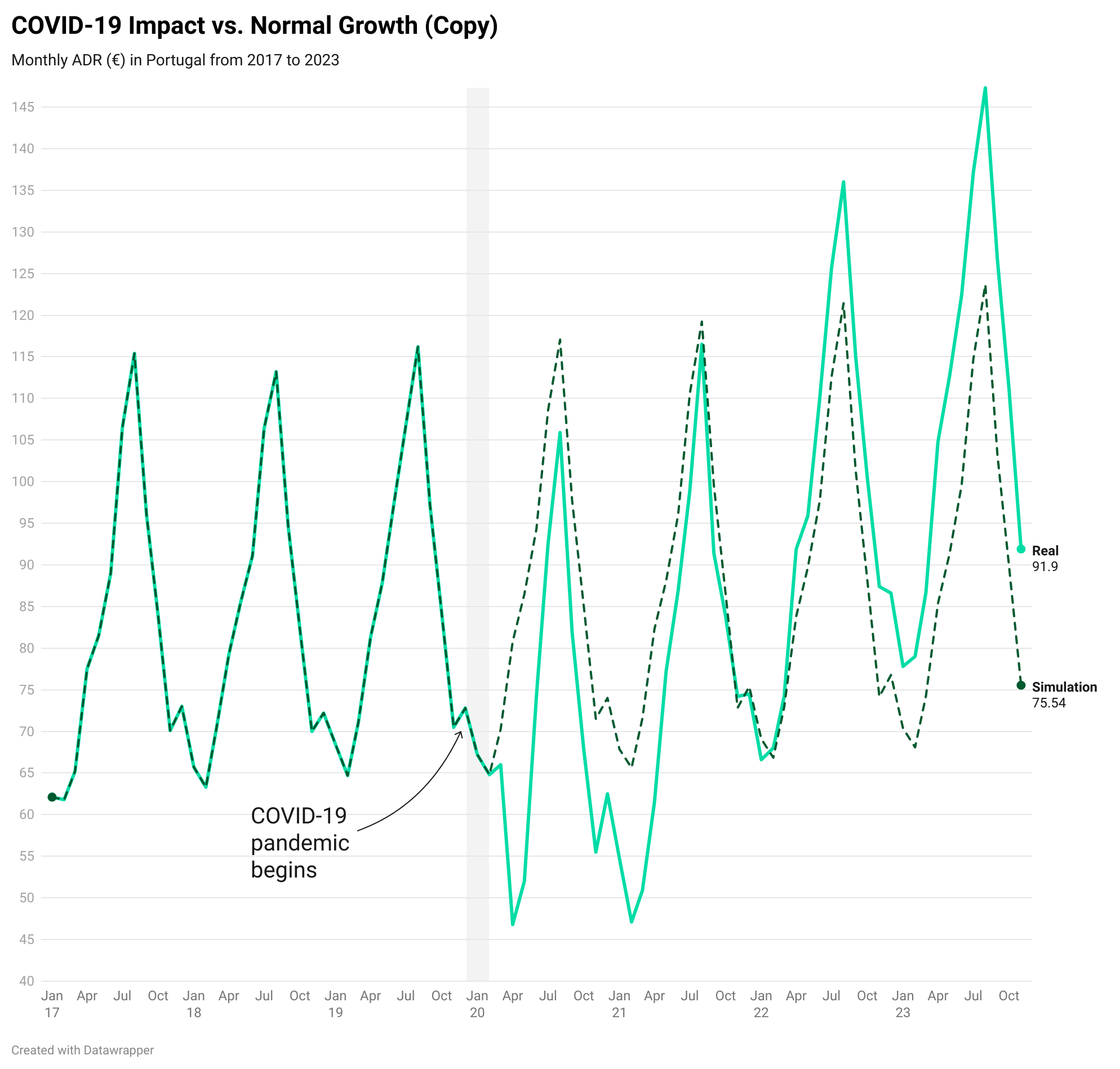

Contrary to expectations, this sector not only recovered but reached unprecedented values, Figure 1; a powerful phenomenon that simulates a pendulum swing effect. Comparing ADR yearly growth through the three previous and posterior years to COVID-19 pandemic, it is worth mentioning the extraordinary increase observed from 2021 to 2023 (~42%, Figure 2A. Nevertheless, that growth did not have the same impact on every region from Portugal. Figure 2B shows how the most vacational regions, such as North (42.1%), Lisboa area (69.2%) and Algarve (29.1%) where those with highest ADR increases while the Center, Lisboa area, Azores and Madeira islands increased around a 25%.

A

A  B

B

Figure 2. A) Percentage of ADR growth during the specified periods. B) Percentage of ADR growth between 2021 and 2023 in each region from Portugal.

Overall consistent upward trend over the past three years raises several questions within the hospitality community: Will the industry sustain this rapid growth? Can the sector bounce back or approach pre-pandemic levels? And crucially, how can the community adjust prices dynamically to overcome the different scenarios?

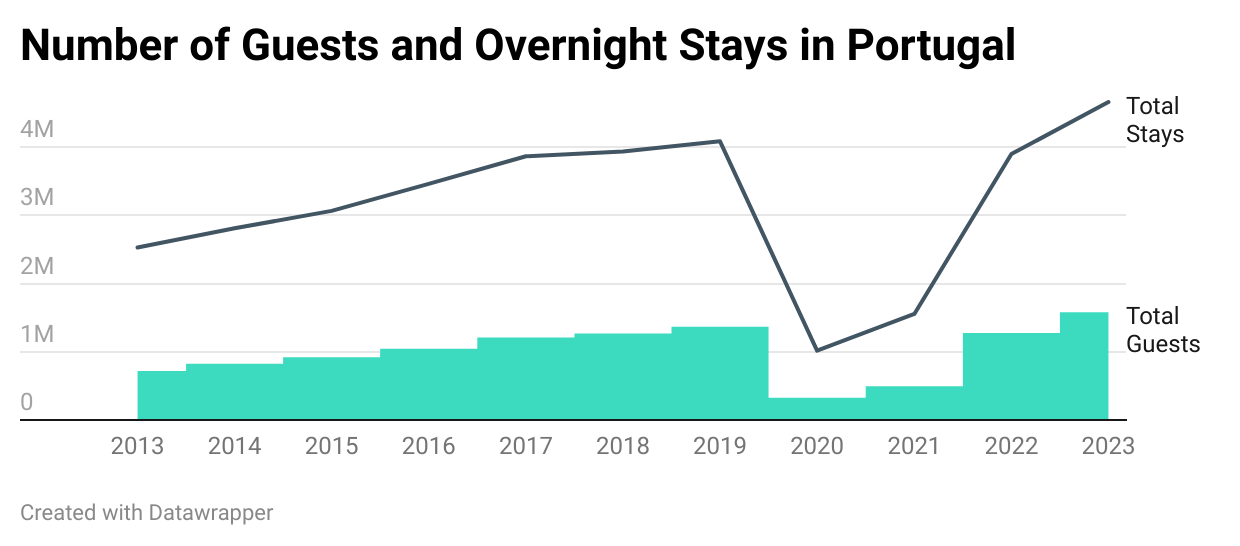

Pre- and post-pandemic data suggest that tourists started to travel as soon as the world was getting closer to “normality”. So the social response to achieving a “normal” situation favored the Hospitality Industry. As it can be seen in Figure 3, Portugal hosted a total of 1.27M guests in 2022, almost achieving the 1.37M guests visiting in 2019. Therefore, the interest of tourists to make up for lost time and start traveling again after the quarantine increased hospitality demand; and of course, the hotels’ efforts to recover from income losses during the pandemic, make possible for the latter to maintain occupancy with higher prices and reach their recovery and even beyond.

Figure 3. Number of guests and overnight stays progression in Portugal: 2013 – 2023

What factors could explain this growth?

The primary determinant impacting hotel advantages is the economic downturn resulting from the COVID-19 pandemic, which has led to pricing adjustments due to extraordinary circumstances (lack of demand). However, as the situation approached the “new normal”, tourists began to resume travel, and the demand for hotels started to rebound.

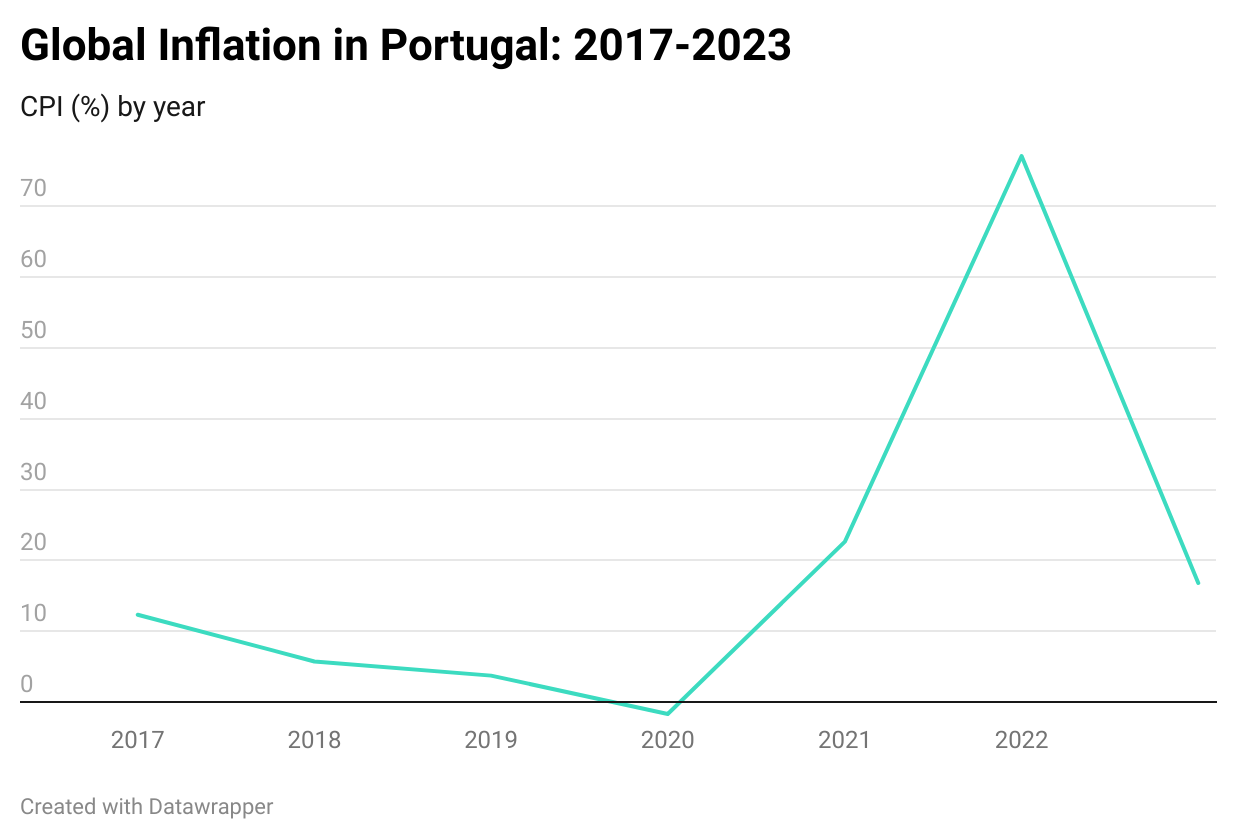

Surprisingly, these levels not only recovered but raised unexpected limits never seen before. Since the Portuguese economy is highly dependent on tourism, the high demand favored inflation to reach significant levels during that period (Figure 4), increasing the costs around the Hospitality Industry and making adjustments necessary. As we mentioned previously, ADR values surpassed pre-pandemic values in 2022, and if we compare that information with CPI evolution, we observe that the highest peak was captured in 2022, revealing that recovery took longer for Portugal than Spain.

Figure 4. CPI levels in Portugal from 2017 to 2023.

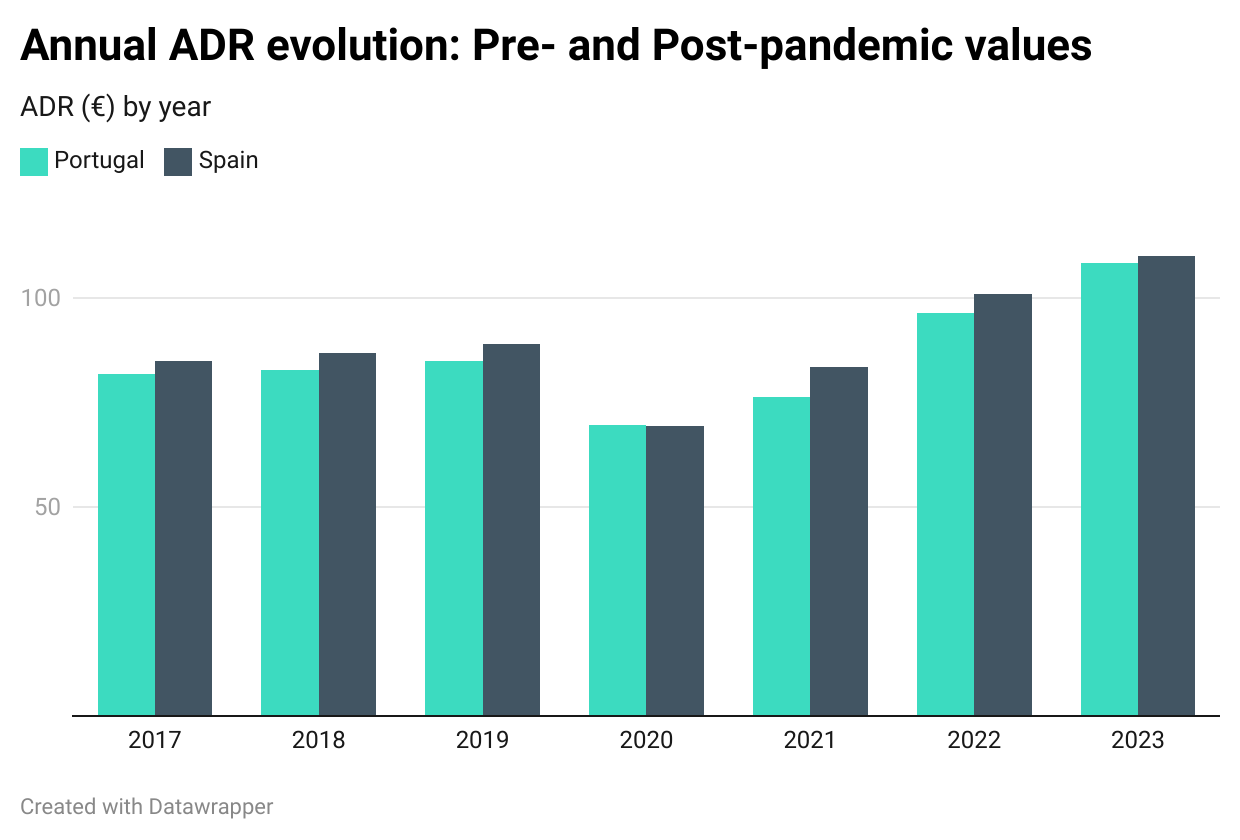

As COVID-19 pandemic had a relevant worldwide impact on the tourism sector, a similar annual ADR evolution was observed for other countries’ Hospitality Industry, as Spain (Figure 5); which at the end is a country with similar geographic location, climatic conditions and cultural environments than those of Portugal. Nevertheless, it is curious how Spain approached approximately pre-pandemic ADR values in 2021 whereas Portugal required two years. This could be due to the different evolution of Consumer Price Index (CPI) for each country.

Figure 5. Yearly ADR evolution in Portugal and Spain from 2017 to 2023

What lies ahead?

The future is inherently uncertain, marked by unpredictable factors. Historically, the hospitality industry has experienced cycles of rapid expansion followed by more moderate growth, leading to price stabilization. Actually, in nature, every extreme situation tends to search for equilibrium, as the swing of a pendulum. So according to this premise, we could expect these prices to stabilize in the long-term. However, over the last three years, there has been a noticeable global trend of consistent growth and hotels should be ready to adjust to these exceptional situations. Let’s explore potential scenarios and discuss how hotels can adapt to them:

- High Growth: Despite the challenge of sustaining current growth rates, it’s feasible to maintain recent positive trends over time. Factors contributing to optimism include Portugal’s ongoing evolution, sustained economic recovery, international investment on Portugal’s hospitality services (link) and enhanced consumer confidence.

- Moderate Growth: A compromise may arise where the industry prioritizes customer experiences enhancement and adopts strategic advancements. This approach would lead to a balanced trajectory, avoiding extremes and aiming for long-term stability.

- Slight Correction: Alternatively, the industry might experience unexpected challenges prompting a minor price correction. Economic changes, evolving travel preferences, or external disruptions could hinder growth evolution. However, the hospitality sector can apply resilient strategies to minimize risks.

How do hotels ensure that their price dynamically adapts to different scenarios?

In light of the multifaceted dynamics within the hospitality industry, setting room prices for the future is a tedious task, particularly during periods of uncertainty. Macro factors, such as economic fluctuations, technological advancements, demographic transitions, political landscapes, and socio-cultural trends, exert profound influences on the operational dynamics and trajectory of the industry. Forecasting these factors and their influence on the hospitality industry a year ahead could lead to better strategic planning and decision-making.

Of particular importance are aspects such as Pick Ups and Incoming Reservations, which serve as critical variables in this dynamic environment. Hotels benefit from strategically pricing rooms over time and employing multichannel alternatives to optimize room occupancy.

Traditionally, predictive trends have relied on historical data, which may no longer be sufficient given the evolving market dynamics and aggressive emergence of new trends. Consequently, there is an imperative need for a paradigm shift towards a more comprehensive approach. This is where Artificial Intelligence (AI) assumes outstanding importance in the hospitality industry. AI tools not only provide valuable insights but also facilitate proactive decision-making. By using forecast models and revenue optimization strategies, hotels can anticipate market complexities and react accordingly.

These AI tools play a pivotal role in dynamic pricing optimization, occupancy forecasting and optimization, and revenue forecasting. By integrating proactive responses with meticulous data analysis and pattern recognition, hotels can maintain a competitive edge and adapt to evolving market dynamics.

As the hospitality industry maps its path forward, the importance of AI cannot be emphasized enough. It surpasses its role as a simple tool, emerging as a strategic ally that empowers hotels to navigate uncertainty, make data-driven decisions, and enhance performance in a dynamic landscape.

Data sources: National Statistics Institute, Spain; National Statistics Institute, Portugal