Analyze Your Competitors to Improve Hotel Revenue

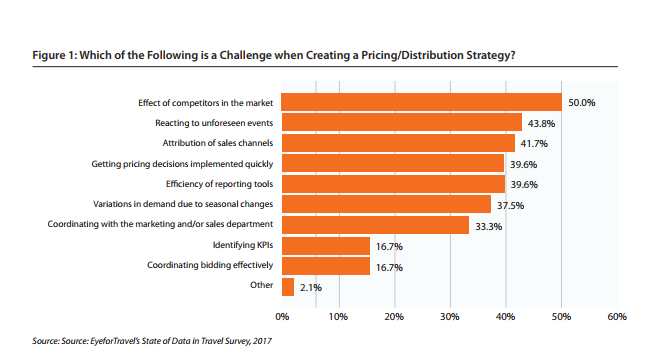

The goal is to maximize revenue by predicting consumer behavior and optimizing inventory and price availability. Once you determine who your competitors are and analyze how they are positioning themselves in the market, you can develop and implement a strategy to increase ROI. Recently, EyeforTravel launched aAggregating Data Streams for More Effective Revenue Management” analyzing the effect of competitors on strategy development and the difficulties this causes hoteliers with developing their own pricing strategy. For 43.8% of respondents, unforeseen events are the next big challenge, followed by sales channel attribution, one of the major challenges faced by digital marketing and hotel distribution analysis.

In the past five years, it has become increasingly difficult to predict and measure the impact of the competitive environment. Market fragmentation complicates this task, and at the same time makes it difficult to track how distribution is being managed. The rise of hotel comparison sites, like OTAs and metasearch engines have made it easier to compare hotel prices. Further complicating analysis and the implementation of future strategies are factors like parity pricing, uncontrolled intermediation or price changes in the currency regarding market of origin.

So now what? Well, here’s what revenue managers can do to understand their competitors better and maximize their hotel’s performance in such competitive markets:

1) Build a thorough competitive set.

Your ‘compset’ must include others factors in addition to proximity. Revenue managers must go beyond to understand their hotel’s attributes and how they attract certain types of guests. You may even need to consider competitors in other markets whose existence was probably unknown to you or competitors who compete directly with you at certain times of the year.

2) Establish your ideal pricing strategy.

EyeforTravel’s study reveals that dropping prices to compete could cause long-term damage. In general, hotel’s that maintained higher than average daily rates (ADRs) experienced better performance. Price reductions did not boost occupancy enough to compensate for the shortfall in income. Additionally, price is not the only factor that is considered by travelers when booking a hotel room. There are a whole range of factors like location and amenities that are also considered. Travelers may perceive a lower quality with hotels that significantly reduce room prices and may cause travelers to lose interest in booking with them.

3) Consider the unique selling proposition of each hotel.

Each hotel needs to consider their own advantages and not only look at their competitors. Price wars not only affect your competitors’ bottom line, but your as well. Alex Hadwick, Director at EyeforTravel, warns against setting prices lower than 5% than the competition. It’s important to analyze the market not only by room rates or units offered, but by all business units that help convert your hotel into a “perfect machine” that provides high value to travelers and profit to revenue managers.

Once you have identified your competition by product, price, location and services, you will be better equipped to understand your market position. BEONx’s BQI takes into account more than 21 objective quality features such as, location, amenities, online reputation, room size, etc., allowing you to compare your hotel’s market position one-on-one with competitors.